Inflation's Impact on eCommerce

Article by Cihan Uzunoglu | July 17, 2023

Download

Coming soon

Share

Inflation was arguably a distant echo in the realm of eCommerce prior to the pandemic. Yet, as the world turned upside down, so did this norm.

Before the pandemic, the eCommerce sector's broad marketplace provided a buffer against conventional inflationary forces, with competitive pricing strategies and supply chain cost savings often leading to lower consumer prices. However, the pandemic brought a seismic shift. The explosion in online shopping, combined with global lockdowns and labor shortages, stressed supply chains and drove costs upwards. Further compounded by wider economic disruptions, including rising energy costs and commodity shortages, the online retail space began to face unprecedented inflationary pressures, moving inflation from the periphery to the core of the digital commerce story. An example of this is the global chip shortage that has disrupted the production of electronic chips, particularly graphics cards and other chips for the consumer market. Increased demand during the pandemic, manufacturing disruptions, limited capacity and supply chain issues have caused prices to soar and created a shortage.

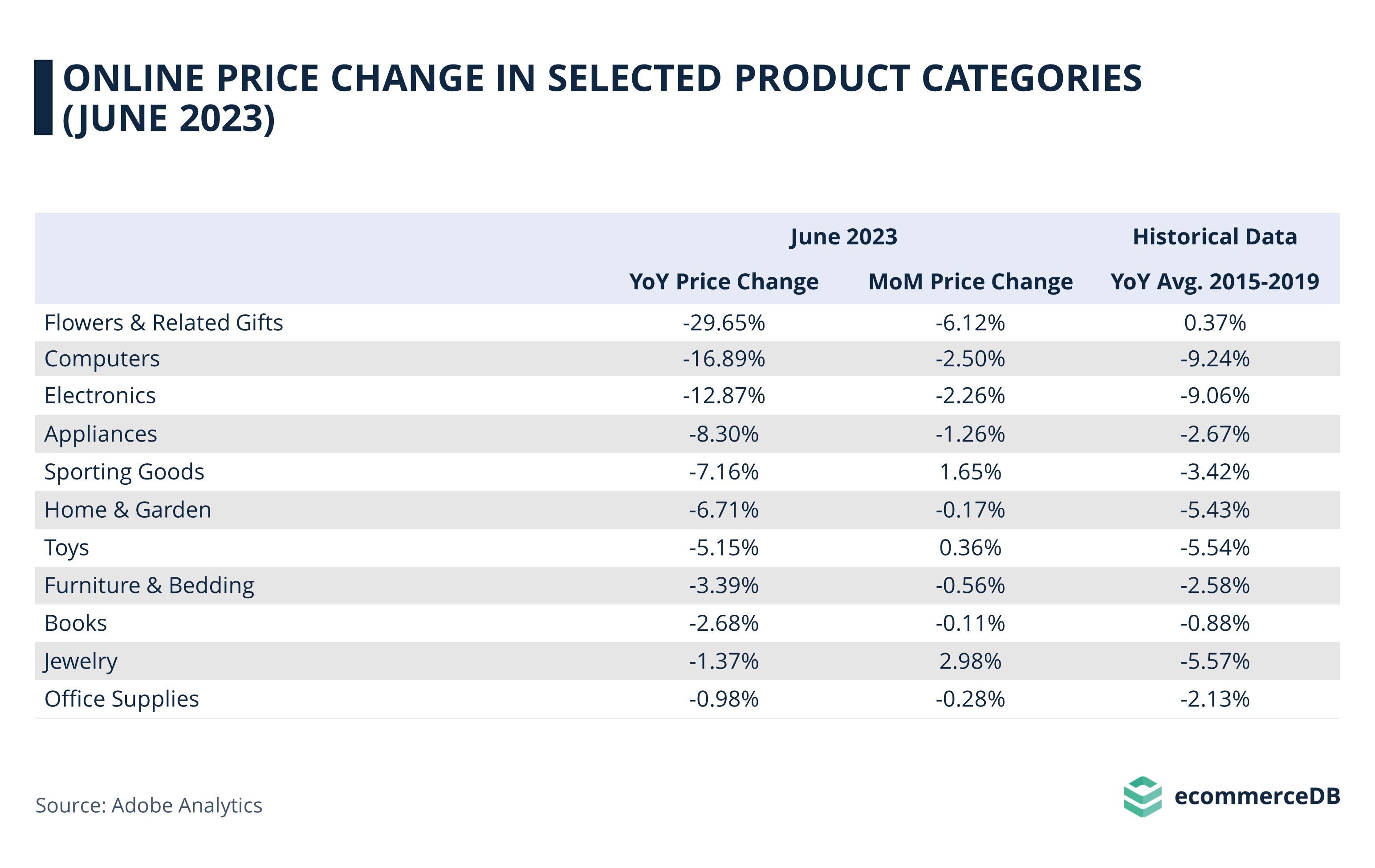

eCommerce: Inflation Declining

In navigating this evolving landscape, deciphering the subtle shifts and turns in online consumer expenditure is more important than ever. Recent data shows that online prices in many categories are on a downward journey. Adobe’s Digital Price Index (DPI) for June 2023 reveals a noteworthy decrease in online prices, marking the tenth month of such decline. The decline was primarily driven by significant drops in the prices of electronics, computers or appliances, since the problems mentioned above are mostly solved. In June, more than half of the categories tracked by the DPI saw a year-over-year price decrease, with the steepest fall being in the flowers and related gifts category.

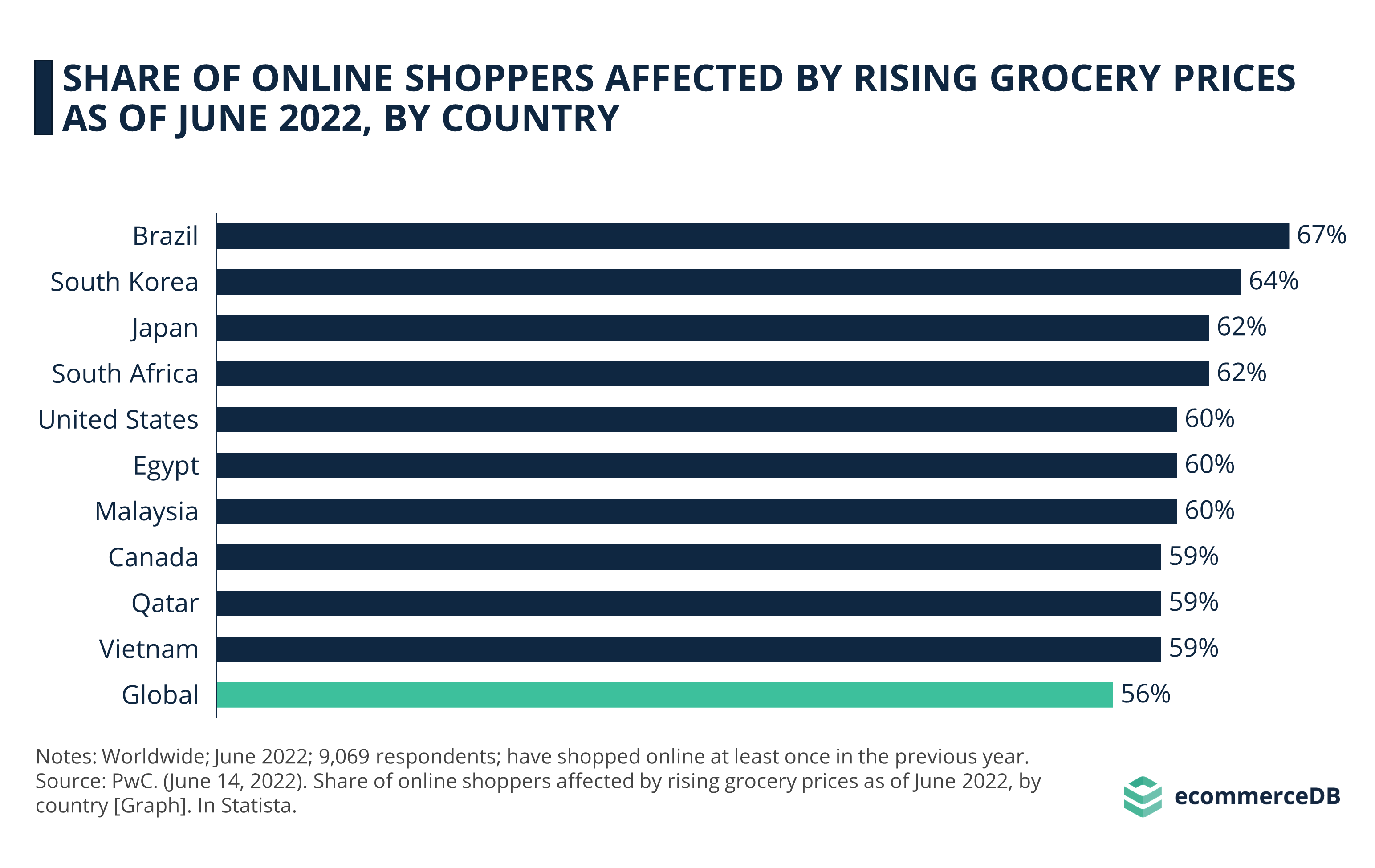

Brazil Has the Highest Share of Online Shoppers Affected by Rising Grocery Prices

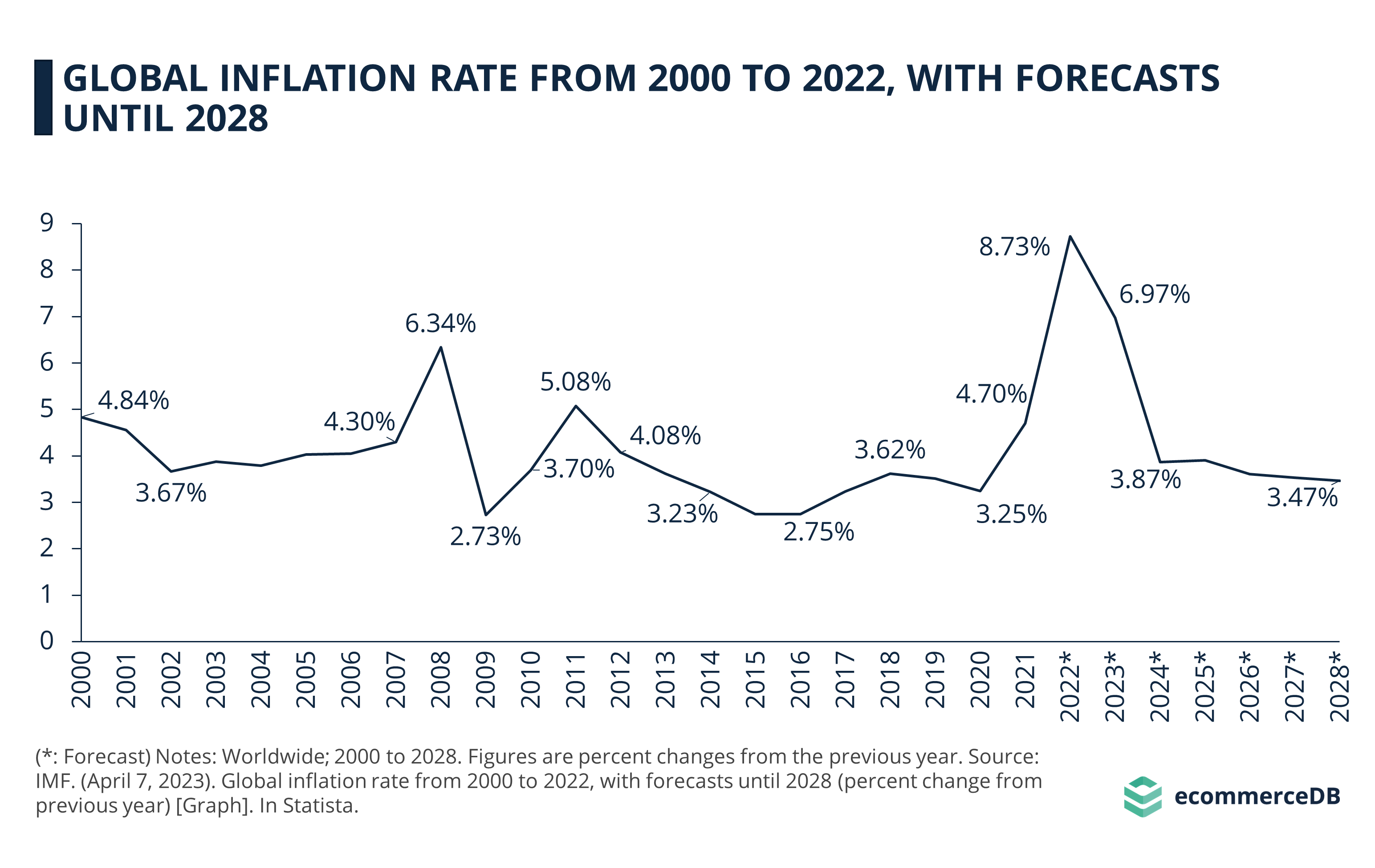

The transformation in eCommerce is a part of a larger, complex tableau, where the consistent, yet fluctuating pulse of global inflation plays a significant role. This pulse has been mostly steady since the turn of the millennium, sometimes interrupted by sudden surges. But to fully comprehend inflation’s impact on our digital narrative, we must examine its trajectory and the profound influence it has had on economies worldwide.

After enduring rampant worldwide inflation throughout the 1980s and 1990s, there has been a remarkable consistency in global inflation rates since the start of the 2000s, typically fluctuating between 3 to 5% annually. A notable surge was observed in 2008, triggered by the global financial meltdown widely referred to as the Great Recession. However, the 2010s saw a relative stabilization of inflation, up until the onset of the present inflation crisis in 2021.

Inflation’s effects, as expected, are not evenly distributed across the globe. The nuances of this economic phenomenon have a distinct impact on the cost of everyday necessities, particularly groceries, and these impacts are felt more acutely in some countries than in others. Recognizing these geographical variations in inflationary pressure is critical to understanding the broader economic picture.

Per a worldwide survey conducted in June 2022, the majority of online shoppers identified escalating grocery prices as a problem when shopping on the internet. Close to 70% of online shoppers from Brazil indicated that the upswing in food prices impacted their purchasing habits, followed by South Korea, which had the second-largest percentage of respondents acknowledging this problem, standing at 64%.

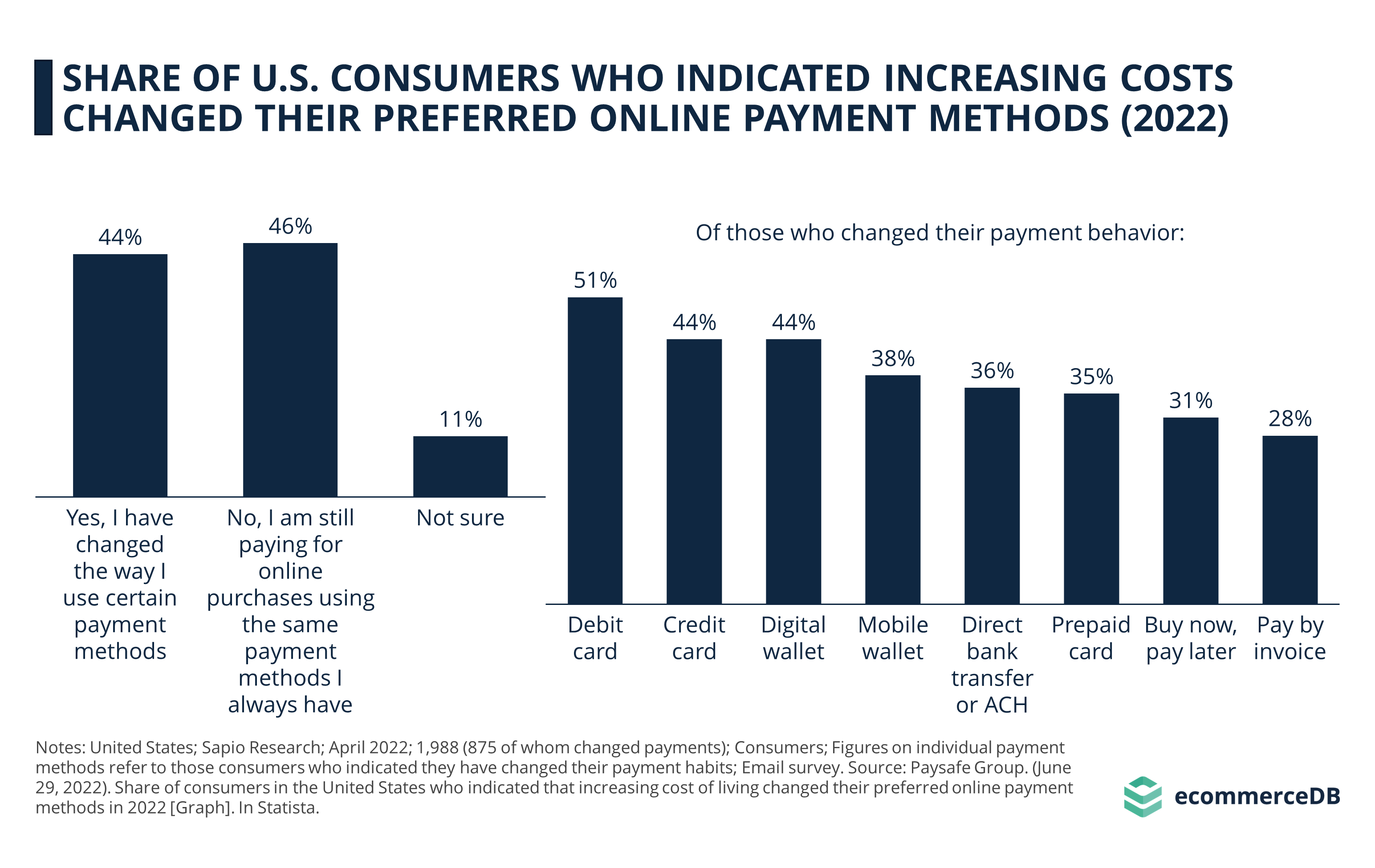

Increasing Costs Changed the Preferred Online Payment Methods of Almost Half of U.S. Consumers

Presenting considerable challenges and opportunities for the eCommerce sector, the evolving landscape of inflation has a profound ability to significantly alter consumer habits. As the cost of living rises, many consumers gravitate towards more frugal spending behaviors. This shift towards cost-consciousness can dampen demand for certain items, leading to potential declines in sales and earnings for eCommerce businesses. In this environment, the operational costs of these firms are directly influenced, placing increased importance on strategic planning and resource management.

The primary challenge confronting consumers globally has been the escalating costs of groceries. Approximately two-thirds of brick-and-mortar store shoppers and over half of eCommerce consumers indicated that they experienced the effects of soaring grocery prices during their shopping activities. Alongside this, a substantial proportion of consumers surveyed worldwide also had to grapple with the predicaments of product shortages and delayed deliveries.

Amid these escalating costs of groceries and the associated challenges of product shortages and delayed deliveries, consumers have not only had to adjust their shopping behaviors but also their payment methods. In this vein, it's essential to explore how these inflation-induced shifts have influenced the way consumers pay for their purchases, especially within the realm of eCommerce.

The rise in living costs last year led to a shift in online payment methods in the United States, with half of the survey respondents indicating an increased use of debit cards. This survey, conducted across 10 diverse countries in North America, Europe, and Latin America, primarily investigated how the cost of living affected payment behaviors in these regions. While usage of credit cards, Buy Now Pay Later (BNPL) services, and cryptocurrencies also experienced a rise, none of them saw the most significant increase. According to the survey, 51% of respondents who adjusted their payment habits due to the escalating cost of living in 2022 reported using their debit cards more frequently for online payments compared to the previous year.

Customer Experience Is More Important Than Ever

In these challenging times, one key strategy gaining prominence among eCommerce businesses is enhancing the customer experience. In an era where commodities' costs are on the rise, businesses might find themselves investing more in operational aspects such as advertising and marketing. This is not solely to attract customers but to foster a satisfying and engaging customer journey. These tactics could include targeted advertising that resonates with customers' needs, personalized marketing messages that cultivate a relationship with the consumer, and diligent post-purchase support to help ensure satisfaction. While these increased expenses could thin profit margins, they also represent a necessary investment in crafting a holistic customer experience, ultimately maintaining a competitive edge in the market.

Retailers who successfully improve their customers' shopping experience are particularly well-positioned in this economic climate. The creation of a "holistic customer experience" has emerged as a fundamental component of a successful eCommerce strategy. The crucial strategy here is to foster customer loyalty in a way that motivates repeat purchases and increases the frequency of transactions.

As cost pressures intensify, businesses are pivoting from spending heavily to acquire new customers to focusing on enticing their existing customers to place new orders. By leveraging strategies like special communities or product ranges tailored to specific target groups, companies can foster a strong sense of customer loyalty and inspire repeat purchases.

Key Takeaways

The transformations we've discussed in this article, from the pervasive impact of inflation to the significant alterations in consumer behavior and payment methods, are all shaping the future of digital commerce. However, it's not just about understanding these changes; it's about integrating them into actionable strategies for businesses to thrive in a market that's as challenging as it is full of potential. Here are some key takeaways, summarizing the most pivotal aspects of our analysis:

The COVID-19 pandemic led to unprecedented inflationary pressures in eCommerce due to global lockdowns, labor shortages, and supply chain disruptions, exemplified by the global chip shortage. However, recent data such as Adobe's DPI indicates a 10-month trend of decreasing online prices across many categories.

Geographical variations in inflationary impact are significant, as exemplified by 70% of Brazilian and 64% of South Korean online shoppers altering purchasing habits due to rising food costs.

Rising living costs are changing global consumer behavior, including a specific increase in U.S. online shoppers' debit card usage (51%) and widespread issues with product shortages and delivery delays.

As the economic climate intensifies cost pressures, eCommerce businesses are increasingly prioritizing the enhancement of customer experience and fostering customer loyalty to motivate repeat purchases and frequent transactions, signaling a shift from a focus on customer acquisition to customer retention.

Sources: Forbes, McKinsey & Company, Adobe, EcomCrew, E-Commerce Institut Köln, Statista, ecommerceDB

Related insights

Article

eCommerce Market in Europe 2024: On Its Way to 1 Trillion Dollars

eCommerce Market in Europe 2024: On Its Way to 1 Trillion Dollars

Article

Buy Now, Pay Later in Germany: Top Providers & Demographic Factors

Buy Now, Pay Later in Germany: Top Providers & Demographic Factors

Article

Buy Now, Pay Later (BNPL) in the U.S. 2023: Consumer Behavior, Analysis & Providers

Buy Now, Pay Later (BNPL) in the U.S. 2023: Consumer Behavior, Analysis & Providers

Article

Buy Now, Pay Later (BNPL) Explained: What It Is & How It Works

Buy Now, Pay Later (BNPL) Explained: What It Is & How It Works

Article

Poland’s eCommerce Trends 2023: Market Share, Payment Methods & Amazon

Poland’s eCommerce Trends 2023: Market Share, Payment Methods & Amazon

Back to main topics